IRS 15227 2021 free printable template

Show details

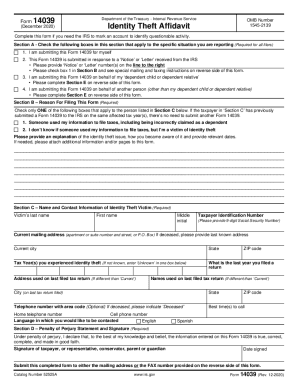

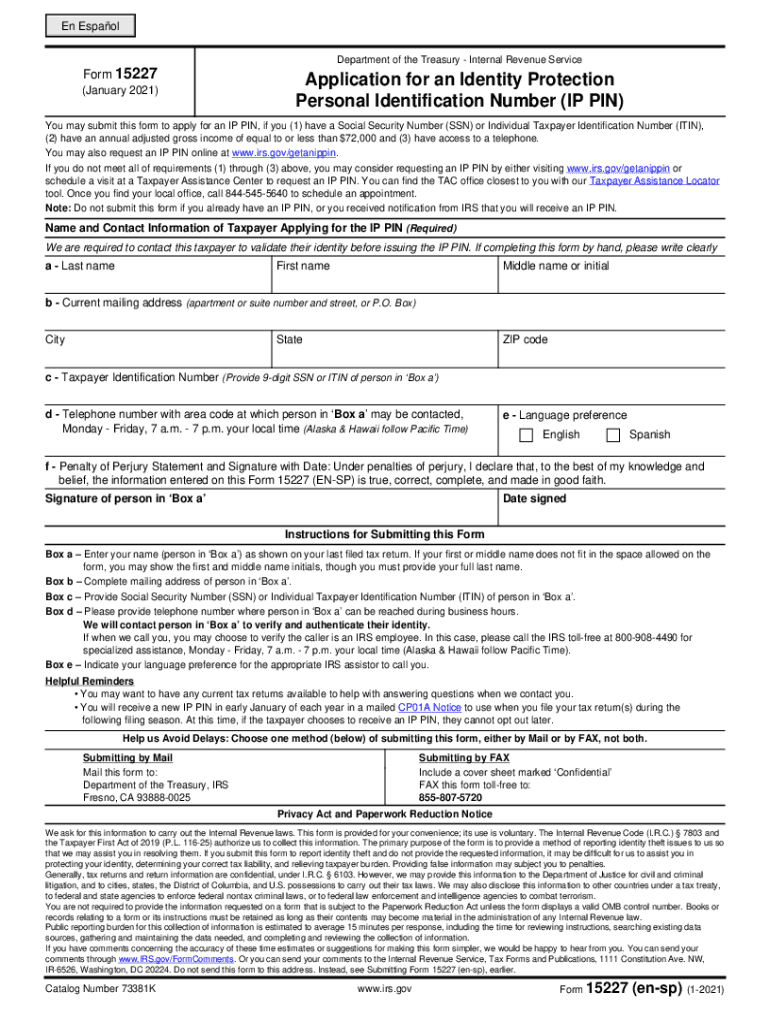

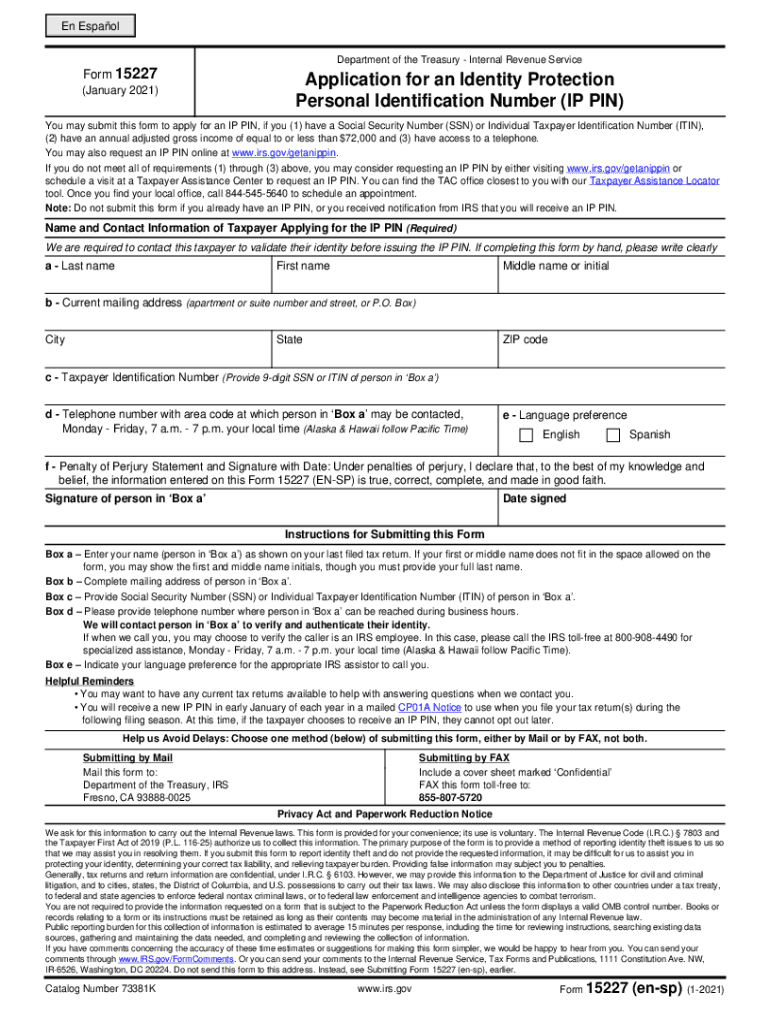

En Español Department of the Treasury Internal Revenue ServiceNow 15227 (January 2021)Application for an Identity Protection Personal Identification Number (IP PIN)You may submit this form to apply

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 15227

Edit your IRS 15227 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 15227 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 15227 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 15227. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 15227 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 15227

How to fill out IRS 15227

01

Obtain the IRS Form 15227 from the IRS website or your local IRS office.

02

Read the instructions carefully to understand the purpose of the form.

03

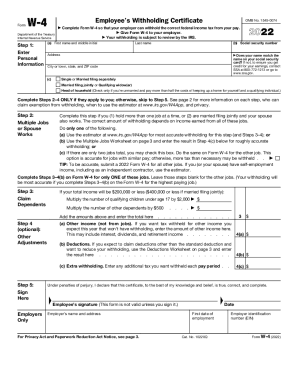

Fill in the required personal information, including your name, address, and taxpayer identification number.

04

Provide the relevant tax information as requested on the form.

05

Review your entries for accuracy before finalizing the form.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate IRS address provided in the instructions.

Who needs IRS 15227?

01

Individuals or entities that need to provide additional documentation to the IRS regarding their tax status or claim certain tax benefits.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get an IP pin from the IRS?

After the taxpayer passes authentication, an IP PIN will be mailed to them within three weeks. Taxpayers should never share their IP PIN with anyone but their tax provider. The IRS will never call to request the taxpayer's IP PIN, and taxpayers must be alert to potential IP PIN scams.

How do I know if I received an IP pin from IRS?

If you know you need an IP PIN to file your taxes and you lost your CP01A letter (or never received it), you can: Retrieve your IP PIN online at the IRS's Get an IP PIN site; or. Call the IRS at 1-800-908-4490 to have your IP PIN mailed to you (this can take up to 21 days)

Is it a good idea to get an IP pin from the IRS?

Taxpayers should request an IP PIN: If they want to protect their SSN or ITIN with the IRS, If they want to protect their dependent's SSN or ITIN with the IRS, If they think their SSN, ITIN or personal information was exposed by theft or fraudulent acts or.

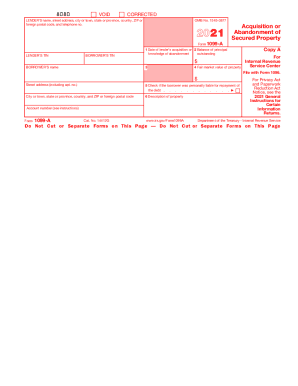

What is a 15227 form?

Filing an application for an IP PIN If your adjusted gross income on your last filed return is below $73,000 for Individuals or $146,000 for Married Filing Joint and you can't use the online tool, you have the option to use Form 15227, Application for an Identity Protection Personal Identification NumberPDF.

Does the IRS send a new IP pin every year?

A new IP PIN will be generated each year. If we assigned you an IP PIN, you must use it to confirm your identity on any return filed during the current calendar year. This includes current year returns as well as any delinquent tax returns. An IP PIN is used only on Forms 1040, 1040-NR, 1040-PR, 1040-SR, and 1040-SS.

How do I get my 6 digit PIN from the IRS?

Other ways to get an IP PIN Taxpayers with income of $72,000 or less should complete Form 15227 and mail or fax it to the IRS. An IRS employee will call the taxpayer to verify their identity using a series of questions. Those who pass authentication will receive an IP PIN the following tax year.

Why is the IRS asking me for an IP PIN?

filing any Forms 1040 during the calendar year beginning in January. The IP PIN helps verify a return filed with your social security number was filed by you. If you fail to use your assigned IP PIN, we could reject your return or delay the processing of your return.

How do I find my 6 digit IP pin for the IRS?

How to get your IP PIN reissued. If you're unable to retrieve your IP PIN online, you may call us at 800-908-4490 for specialized assistance, Monday - Friday, 7 a.m. - 7 p.m. your local time (Alaska & Hawaii follow Pacific Time), to have your IP PIN reissued.

Does the IRS send a new IP PIN every year?

A new IP PIN will be generated each year. If we assigned you an IP PIN, you must use it to confirm your identity on any return filed during the current calendar year. This includes current year returns as well as any delinquent tax returns. An IP PIN is used only on Forms 1040, 1040-NR, 1040-PR, 1040-SR, and 1040-SS.

How long does it take to get an IP pin from the IRS online?

An assistor will verify your identity and mail your IP PIN to your address of record within 21 days.

How do I get my IP PIN reissued?

How to get your IP PIN reissued. If you're unable to retrieve your IP PIN online, you may call us at 800-908-4490 for specialized assistance, Monday - Friday, 7 a.m. - 7 p.m. your local time (Alaska & Hawaii follow Pacific Time), to have your IP PIN reissued.

How long does it take to get a new IP pin from IRS?

We will use the telephone number provided on the Form 15227 to call you and validate your identity. Once we verify your identity, you will receive your IP PIN via the U.S. Postal Service usually within four to six weeks. You will then receive your IP PIN annually through the mail.

What is an IP PIN?

An Identity Protection PIN (IP PIN) is a 6-digit number that the IRS gives taxpayers who were victims of tax-related identity theft. The IP PIN validates a Social Security number's true owner and prevents future tax fraud.

What happens if I file my taxes without my IP PIN?

If you were issued an IP PIN, you must use it when you file taxes. If you don't, the IRS will reject your electronic return and you won't be able to e-file. Filing a paper return without an IP PIN means that the IRS will need to do additional screenings to verify your identity which can delay any refund you may be due.

What do I need to do to prove my identity to the IRS?

Before calling the IRS, people should know what info they'll need to verify their identity Social Security numbers and birth dates for those who were included on the tax return. An Individual Taxpayer Identification Number letter if the taxpayer has an ITIN instead of an SSN.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 15227 for eSignature?

Once your IRS 15227 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my IRS 15227 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your IRS 15227 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out IRS 15227 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign IRS 15227 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is IRS 15227?

IRS 15227 is a form used by taxpayers to request a Certificate of Compliance for certain tax-related matters.

Who is required to file IRS 15227?

Individuals or entities who need to confirm their tax compliance status for certain legal or financial purposes may be required to file IRS 15227.

How to fill out IRS 15227?

To fill out IRS 15227, taxpayers should provide their personal information, details about the compliance request, and any other required documentation as specified by the form instructions.

What is the purpose of IRS 15227?

The purpose of IRS 15227 is to provide a formal method for taxpayers to certify their compliance with tax obligations when required by third parties.

What information must be reported on IRS 15227?

Information reported on IRS 15227 typically includes taxpayer identification details, the reason for the compliance request, and any relevant tax information to support the request.

Fill out your IRS 15227 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 15227 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.